Payment aggregator company Visa has signed a deal with Adani Group to launch co-branded cards. Company will be looking to expand its footprint via Adani Group’s consumer data points of over 400 million consumers.

“We signed a co-brand agreement with Indian conglomerate Adani, serving 400 million customers through retail, airports, and online travel services, among others,” Ryan McInerney, CEO at Visa, said during the quarterly earnings call.

Adani Group, which will be seeing more airport acquisitions in the future, will be a good data collector for the American financial company. The partnership will give Visa will also deliver access to customers using online travel booking portal Cleartrip and train booking platform Adani One.

Adani Group has eight airports under its fold, seven brownfield and one greenfield coming up in Navi Mumbai. The seven operational airports are spread in states that contribute 45% of India’s GDP. The passenger traffic at these Adani-run airports jumped 103% YoY to 7.48 cr in FY23.

LATEST UPDATES ON CLEARTRIP, SUPER APP ‘ADANI ONE’

– Adani Enterprises Ltd. currently owns 20% in Cleartrip Pvt. while Adani One, its super app offer railway ticket booking services, is part of the Adani Digital Labs Pvt. Within a month, Adani One onboarded over 10 lakh users. Company expects 500 million users by 2026, offering cross-selling of products of other subsidiaries.

– CHALLENGES FOR CROSS-SERVICES CREDIT CARD MAY BE OVER

Cross channel credit cards have been introduced by many players to cater promotional services. ICICI-Make My Trip card, SBI and Yatra have come up with one, and Axis Bank Vistara credit card and Axis Bank Flipkart card, among others. But with rising interest rates and to mitigate costs, some banks have started creating cracks in the credit card business. Last month, Axis Bank

devalued Axis Magnus credit card rewards for customers. The bank discontinued its 25,000 reward points on ₹1 lakh monthly spend, increased its renewal fee by 25% to ₹12,500 (18% GST extra).

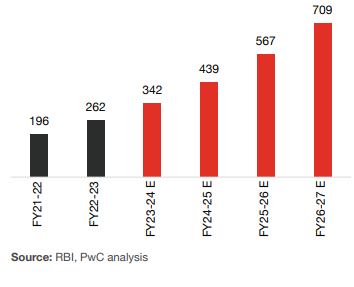

These changes are scheduled to come into effect from 1 September. But with the rise in consumer spending, credit card usage is expected to rise in the coming years (20% CAGR between 2017-22). This augur well for companies giving credit but puts strain on regulatory norms and underwriters.

– LOOKING AHEAD

– With increase in discretionary spending of customers and the wave of digital banking (ONE-STOP ALL BANKING SERVICES), the credit card business may get more share of revenue than before. And with rise in the number of users (8.3 cr credit cards in India, unique users estimated ~4 cr), the percentage of revenue from payment aggregators serve well for third-party service providers.

– As more and more companies come together for payment services, it will be a competitive scenario for Adani Visa JV and more opportunities for companies to explore payment services in India.

To receive the latest EZ Wealth updates, follow us on Twitter, Facebook, and Instagram.